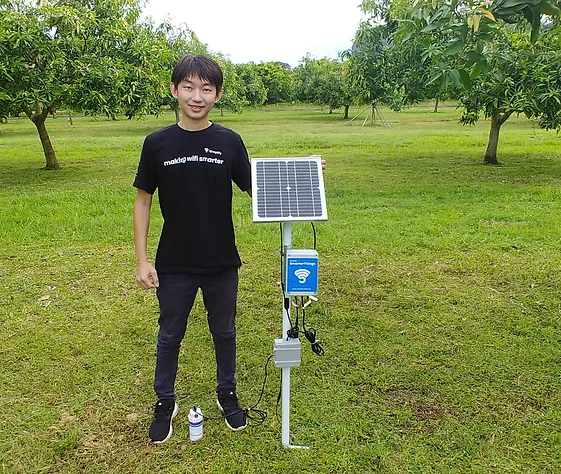

World's First ESG-i Driven Venture Capital Management Company

Founded in 2018, Ficus Capital has quickly risen as a leader in Islamic Venture Capital. With founders boasting over 70 years of combined experience in banking, investment, islamic finance, technology, and entrepreneurship, Ficus Capital stands at the forefront of innovation in responsible investing.

Southeast Asia Focus

Ficus Capital has strategically honed its focus on the vibrant and dynamic Southeast Asia region for its funds. With a deep-rooted commitment to responsible and ethical investment practices, we recognize the immense potential that this region offers. Southeast Asia's burgeoning economies, diverse markets, and innovative entrepreneurial spirit align perfectly with our mission to promote sustainable growth and impact. By concentrating our efforts here, we aim to foster positive change, drive innovation, and catalyze responsible investments that benefit not only our investors but also the communities and environments in which we operate.